New CUSO Wants to Amplify Customer Feedback with Agentic AI

- Roy Urrico

- Oct 15, 2025

- 4 min read

By Roy Urrico

When asked what came first, his development of VeroTerra Amplify, an artificial intelligence (AI)-powered customer feedback platform, or establishing VeroTerra CUSO, serial entrepreneur Ray K. Ragan, co-founder and CEO told Finopotamus, “I'm doing both at the same time.”

In a follow-up to an earlier article in Finopotamus, Ragan – who’s background includes positions as a credit union and fintech executive and an ongoing commitment as an innovation officer in the Army Reserve – explained he became frustrated by the current ways credit union and other financial institutions obtained customer feedback and wanted to create a better way to obtain user responses. Using his experience in Net Promoter Scores (NPS), computer vision, and AI, Ragan invented a new way to easily get customer feedback.

There are a few vendors right now that offer the NPS surveys, which are the intellectual property of Bain and Capital, Ragan explained. “Many organizations use an interpretation of it. Every credit union needs to do it. Many of them have it as part of their executive scorecard but what I have done is I am taking that service that nearly everybody is using and bringing in these AI tools.”

Getting Better Feedback

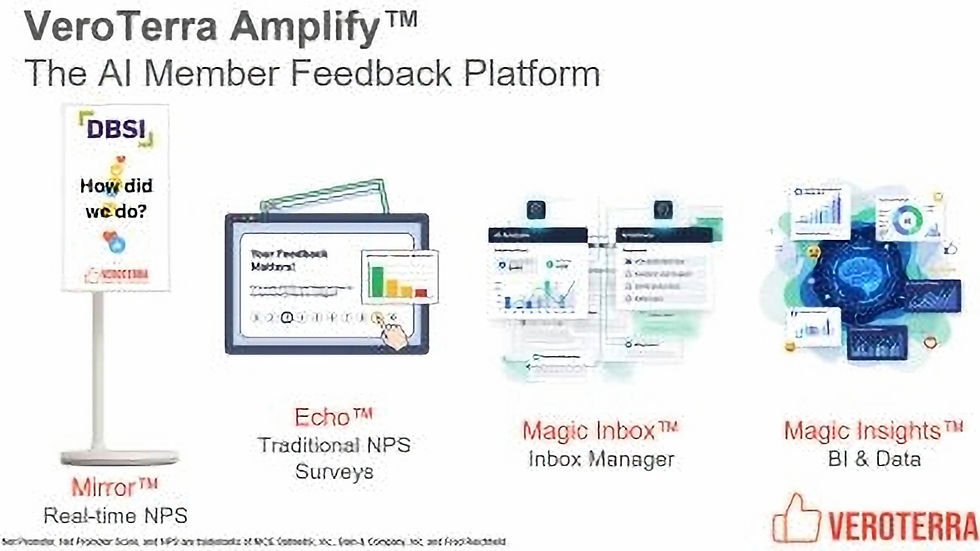

Amplify goes beyond traditional NPS with a patented in-branch, real-time solution, noted Ragan. The VeroTerra Amplify AI member feedback platform consists of four elements:

Mirror - VeroTerra’s patented in-branch real-time NPS component which uses “ethical” AI for instantaneous feedback. “There are four principles behind (ethical AI). One is that it is disclosed; two, that it is consensual; three, that it actually adds to some human value. And then lastly, that it is actually human accountable. Everything that we code, complies with those four principles,” said Ragan. The Mirror, which is ready now, is drop shipped to specific locations.

Echo - Measuring customer loyalty via legacy NPS surveys by asking customers how likely they are to recommend a product or service on a scale of 0-10. Echo is ready now; SMS is coming in 2026.

Magic Inbox – An intelligent inbox manager that uses AI to sort the feedback inbox into a list of actions based on priority. It also provides insights on products and branches. It automatically excludes sensitive member information. Gmail is ready for beta testing; Microsoft Exchange will be ready in the fourth quarter of 2025.

Magic Insights - Provides AI data insights based on NPS data to make meaningful real-time improvements. Magic Insights is in development and schedule for release in the second quarter of 2026.

Ragan said VerroTerra bundled Mirror together with some other pieces because although “going to market with the NPS survey with the real time NPS was interesting and intriguing,” he wanted “to incorporate the excitement surrounding the concept of agentic AI workflows.”

Ragan continued, “The one thing that is coming in 2026, and I am literally working on this right now, is what I like to call Magic Insights. I have discovered over the years is people actually do not want data. I know they say they do what they want are answers. They want knowledge, they want information. They go to the data because they are not getting that. And this is where agentic AI is actually really helpful. I am taking all that NPS data and having AI actually look for those themes, look at where you might potentially have a product problem and some of those bigger insights hidden in the data.”

Over the past decade, Ragan suggested that Microsoft’s business intelligence product, Power BI suite, has dominated the commercial data environment. “I am skipping right past that. I am going right from data right to actionable insights. Now, if somebody still wants to look at the data, the data is still there.”

New Agentic AI

“What this is really about is getting to those agentic AI advantages. I know that I am coming into a saturated market, but that is not what I am really focused on,” explained Ragan. “I know that credit unions do not want another vendor, but what we are adding on top of (NPS) is all these AI tools to really shorten that member feedback cycle. I think a lot of times folks lose sight of the actual why of NPS, and that's member loyalty.”

“Because member loyalty is churn; churn is cost,” emphasized Ragan. “It creates that perpetual cycle of going out there and trying to recapture members. I am really focused on that with these agentic AI tools. Under the hood, Amplify has taken Mirror, which is the real-time Net Promoter score, and bundled it together with these two agentic AI workflows, the one is the Magic inbox, and the other one is Magic Insights.”

Credit unions do not need to buy all four Amplify pieces, Ragan said. “It is essentially à la carte. Either they can do all four or they can do one.”

The CUSO Opportunity

Ragan describes VeroTerra as a pre-revenue tech firm dedicated to making every member AI interaction so good that it is worth telling someone else about it.

“I purposefully structured the CUSO so small and medium credit unions actually could be a part of it, because that's something that I heard a lot over this last year,” Ragan told Finopotamus. “A lot of credit unions vocalized their frustration that they couldn't get into these CUSOs because the big boys would just come in and buy up all the equity and there was nothing to go around.”

Ragan detailed the CUSO proposition. The fintech is seeking 10 credit unions to form a CUSO with VeroTerra. "The full buy-in at 1% is $55,000. If a credit union is interested, what they can do is they can pay that $10,000 earnest payment, and then over the next three years through using the service and paying that annual invoice, actually buy their equity. it is kind of a rent to own method,” noted Ragan. Board seats are available for the first three credit union investors, advisory board afterwards.

“I wanted to make sure that I structured this CUSO in a way that even a small credit union could potentially be a part of it. And the way I did that is I made the cost of entry very low and the ability to buy that equity over a period of three years,” said Ragan