Fintech Meetup 2023 Up Close and Personal

- John San Filippo

- Mar 29, 2023

- 4 min read

By John San Filippo

Fintech Meetup was held March 20-23, 2023, at the Aria Resort & Casino in Las Vegas. This marked the conference’s first installment as a live, in-person conference. The first two installments, in 2021 and 2022, were held virtually due to the pandemic.

The “meetups” – pre-scheduled, 15-minute, one-on-one meetings between attendees who have expressed interest in meeting each other – are what differentiates this conference from most others. Because this format creates such a unique and individualized experience for each attendee, Finopotamus co-founder John San Filippo has chosen to write about his Fintech Meetup experience in the first person – an admitted break from the norm here at Finopotamus.

My Fintech Meetup experience actually began weeks before the conference. Once registration officially closed, attendees were invited to scan through the attendee list, organized by company, to select people they were interested in meeting. You could select as many or as few as you wanted, but 96 was the recommended number. This was presumably to create a surplus because, as I would later learn, the format could accommodate a maximum of 24 meetups per attendee.

Once that selection process closed, the Fintech Meetup software churned through all that data, creating a custom itinerary for each attendee. I had the option to reject any of these, but of course I wanted to meet anyone who wanted to meet with Finopotamus. Once I confirmed my meetups, I received an individual calendar invitation for each meetup that included the time, table number, and other person’s information. I found this especially useful because I had access to the overall conference content via the conference app, but had my personal schedule in my phone’s calendar app – a convenient and familiar place to store such information.

My Meetups

Over the course of two days – March 21-22 – I had a full schedule of 24 meetups. Of those, three never came to fruition:

One appeared to be a no-show, but I believe that person got tripped up by a time zone change. About two and a half hours after our scheduled meetup, I received a direct message on LinkedIn from this person saying she wasn’t going to be able to make our meeting.

One person messaged me in the app that he couldn’t make the meeting.

One person flat-out ghosted me. While I was sitting there by myself, a conference employee came by to scan my badge. Apparently, had I paid for meetups like most non-press attendees, I would have received a refund for that one.

The meetups gave me the opportunity to catch up with a few old friends, among them Craig McLaughlin of Finalytics.ai, Mike Duncan of Bankjoy, Ed Rhea of MEA Financial, Pankaj Jain of Scienaptic, Jim Irwin of Apiture, and Barry Kirby of Union Credit. I also had a chance meeting with Joseph Akintolayo of Deposits, Inc., who was vacating a table just as I arrived for my next meetup. To that point, Joseph and I had only met on Zoom.

I also made plenty of new friends. They include Destinee Day-Cassidy of Finotta, Rob McMurtrie of Array, Graham Goble of BankBI, Donna Blum of BHMI, Julia Lum of Quavo Fraud & Disputes, Betsy Young of the Reseda Group, Drew Cranston of Agent IQ, Sarah York of Spave, Kirsten Longnecker of Plinqit, Tom O'Hare of Arkatechture, David Dindi of Atomic Invest, and Scott Robinson of Prizeout.

The one anomaly was my meetup with Brookelyn Sproviero of the HSP Group. Brookelyn lives in Costa Rica and her company helps organizations with their global expansion efforts. Once I assured her that Finopotamus has no plans for global expansion and she assured me that HSP has never worked with a credit union, we spent the remainder of our meetup trying to figure out how we ended up at the same table. The only thing we had in common is that she was raised in Poway, Calif., which is about 18 miles from my home in Alpine, Calif.

The Same, But Different

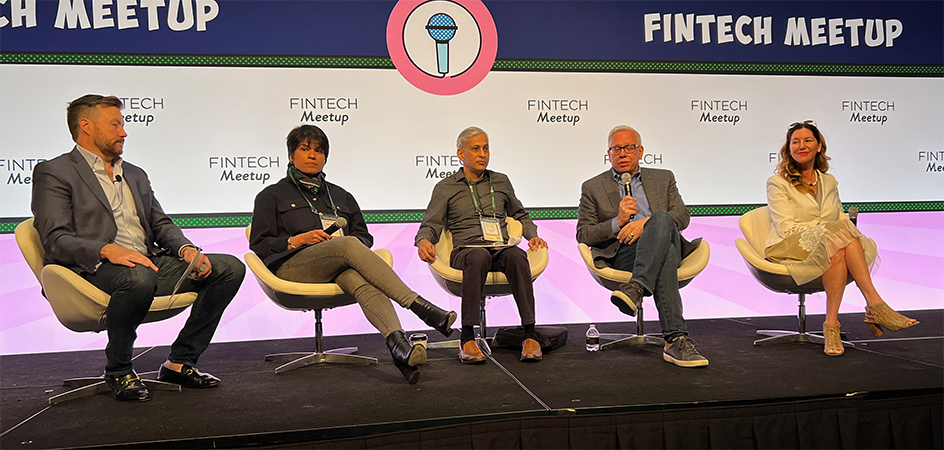

Fintech Meetup had all of the “standard” conference features. For example, there was a wide range of breakout sessions broken down by topical track. However, as best I could tell, all of them were expert panel discussions. I’ve always preferred receiving insights from multiple experts over one person with a PowerPoint deck.

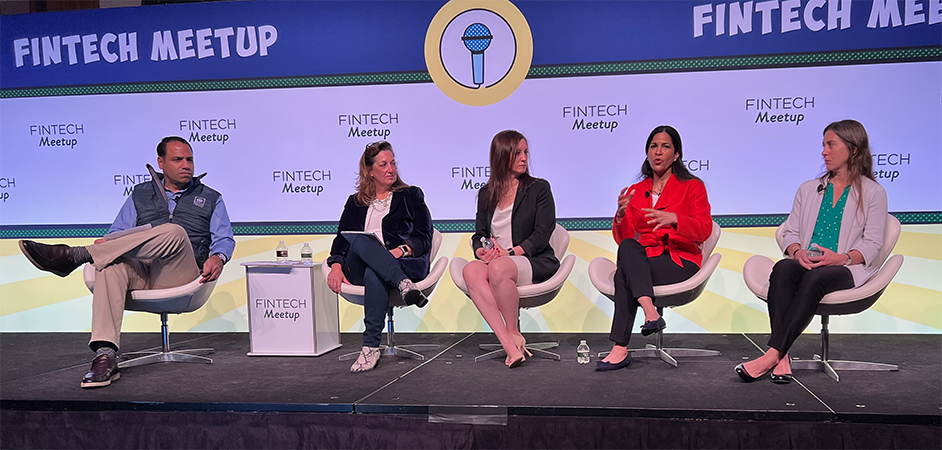

The panelists were true experts, too. I attended one session on the topic of build versus buy. Panelists for that session included:

Brinda Bhattacharjee, Chief Operating Officer for Transaction Banking in Platform Solutions at Goldman Sachs

Biswarup Chatterjee, Global Head of Partnerships & Innovation, Treasury &v Trade Solutions at Citi

Peggy Mangot, Head of Fintech Partnerships, Commercial Banking, at J.P. Morgan

David Foss, Board Chair & CEO at Jack Henry

I attended another session on opportunities in B2B payments. Panelists for that session included:

Elena Whisler, SVP, Relationship Management, The Clearing House

Allison Baller, Vice President & Head of Industry Readiness, FedNow, Federal Reserve Bank of Boston

Yanilsa Gonzalez-Ore, Senior Vice President, North America Head, Visa Direct, Visa

Carrie Blankenship, Payments Innovation Principal - Americas, Volante Technologies

Even the exhibit hall had a unique, chill vibe. In addition to the requisite exhibitors, it included, among other accoutrements, a tarot card reader, a caricature artist, an eight-person foosball table, an arcade-style basketball game and an air hockey table.

Given this was the first-ever in-person Fintech Meetup, I expected a couple of hiccups, but I observed none. From an execution standpoint, the conference appeared near flawless. I suppose that is to be expected, considering this same group of people created the original Money20/20.